Are you interested in Share Market? Do you want to learn about how

to earn from Stock Market? Here you are where you can learn the way how Stock

market works to earn. Wise world21st will help you to understand the structure of earning

path and various stages to earn and also we will share strategy. So let’s start

from Beginning:-😊

Introduction

Share market is where burying and

selling of share happens. So, 1st question is what is share? Let’s

understand:

Share means a unit of Capital of

the company which is divided into small parts. And as you know Capital is nothing

but the investment money of owners which helps in running the business. We will

discuss later about the term ‘Capital’ briefly. That small part of capitals

represents in number.

For Example: A Ltd. Having Capital

of 200 Crores INR. So, this huge money can’t be shared or invested by a small

group of people alone. And also a huge group of people can’t invest money

without any proper specification. For that purpose, the whole capital is

divided into very small part; such as Rs. 200 crore divided into 20 crores

unit, which causes each unit value just Rs.10. Now we can say A Ltd. has 20

crores Equity Share Capital of Rs. 10 each.

I hope, you understand the basic

meaning of share.

As I said, Capital is invested by owner, hence the share who hold

will be treated as owner for that particular share valued capital. It means, as

per above example, If any one hold 10 crores share, then he will be the owner

for Rs. 100 Crore capital or we can say 100/200 crores = 50% owner of the

Company. Let’s say if you have 1 Lakh unit of share of above Company, then you

are also owner and you will take part in the action of the Company. Hey hey! Stop

imagines. You can’t participate in the activity of the company, unless you are

not the part of the Board of the Company. You can only suggest, if you want

that only can happen in General meeting of the company.😜😜

All the above are basic ideas about share, because if you won’t

know what is it, then how can know how works it? Right!

So how you can earn from share? It’s

very simple. Buy share and sell it. The difference you gain is your profit, if

not it may causes loss. So, Buying in share is known as Investing.

Investing in shares allows you to fulfill your dreams. If you start investing as soon as possible and stay invested for a long time, the rate of return will be high.

You can plan your investment strategy based on the time you need money.

By buying

share, you are investing money in the company. As the company grows, the price

of your share will increase. You can get profit by selling the shares in

the market. There are various factors that affect the price of a share.

Sometimes the price can rise and sometimes it can fall. Long term investment

will nullify the fall in price.

Why a company sells it shares to the public?

A company requires capital or money for its expansion,

development, etc. and for this reason it raises money from public. The process

by which company issues shares is called Initial Public Offer (IPO). We will

read more about IPO under Primary Market.

You would have always

heard people talking about bull market and bear market. What are they? Bull

market is one where the prices of stocks keep rising and the bear market is

where the prices keep falling. Where all these buying and selling happens? There

are a lot of Institutions all over the world as Stock Exchange. Some of them

are:

1) New York Stock Exchange (NYSE), US.

2) NASDAQ, United States.

3) Shanghai Stock Exchange (SSE), China.

4) Honk Kong Stock Exchange (SEHK)

5) Japan Stock Exchange (JPX)

6) Shenzhen Stock Exchange (SZSE),

China.

7) EURONEXT, Europe.

8) LSE Group, UK and Italy.

9) NSE, India

10) BSE, India

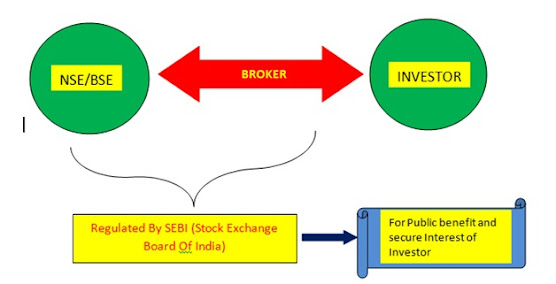

In India, the two measure Stock Exchanges are NSE (National Stock Exchange) and BSE (Bombay Stock Exchange) and are regulated by SEBI (Securities and Exchange Board of India). Brokers act as an intermediary between the stock exchange and the investors. So to start investing or trading, you have to open a demat account and trading account with a broker. You can open Demat Account online easily through a simple process by using the link below. After linking your bank account with these accounts, you can start your investment journey.

Upstox: https://bv7np.app.goo.gl/Msk3PDeVevzThPSa8

Zerodha: https://zerodha.com/?c=AT1313

Types of share Market

There are two kinds of Share Market:

·

1. Primary Market

·

2. Secondary Market

Primary Market:

The

primary market is where shares of a company are distributed or allocated to

public for first time. An initial public offering, or IPO, is an

example of a primary market. These trades provide an opportunity for investors

to buy the shares or bid in the new initiated shares for public. An IPO

occurs when a private company issues stock to the public for the first

time.

·

A company or government raises money by issuing shares in

the primary market by the process of IPO.

·

The issue can be either through public or private

placement.

·

A

privately held company converts into a publicly-traded company when its shares

are offered to the public initially through IPO is known as Public

Placement.

·

When a

company offers its Shares to a small group of investors, it is called private

placement.

·

Qualified

institutional placement is another kind of private placement where a listed

company issues securities in the form of equity shares or partly or wholly

convertible debentures apart from such warrants convertible to equity shares

and purchased by a Qualified Institutional Buyer (QIB).

·

Price of a share can be based on Fixed price or Book building

issue; Fixed price is decided by the issuer and mentioned in offer document;

Book building is where the price of an issue is found out based on the demand

from the investors.

Secondary Market:

For Common buying and

selling shares in OTC platform is called Secondary Market. OTC (Over The

Counter Exchange of India) is an online platform where anyone can buy and sell

any shares with some conditions. The Secondary Market is commonly known as stock

Market which is like NSE and BSE. This is a very simple and easy platform for

investing in shares.

Why we should invest in Share Market?

Share market allows the

companies to raise capital for expansion and growth of its business. Companies

issue shares to the public through IPOs and receive funds from the public that

are used for various purposes. The company gets listed on the stock exchange

after IPO and this provides an opportunity to even a common man to invest in

the company. You can be a Intraday trader, Swing Trader or investor in the

share market.

Intraday Trader:

Intraday Traders are the trader who comes up with low

capital and use margin of broker to buy and sell share. Margin is nothing but

the extra benefit provided by broker to take trade in the same day. Trade means

Buying and selling, which means end of a complete process. They are very quick

and very aggressive. They capture the small-small movement and trade

day-by-day. It contains a high level of Risk and Reward as well. They go for 1-3%

of profit or loss per day.

Positional Trader:

These are the persons who take the trade for more than

one day but not more than 1 week. Mostly Intraday Trader are use the way, when

they find that, the trade is going against their view but it will go with the

view in very near future. Here is avg. 2-5% of Risk and Reward.

Swing

Trader or Mid Term Trader:

These are the person who buy the stock and hold it for a

short period but not less than one week and not more than 1 year. They just

book profit when they achieve target. They specify one level of risk and

reward. It causes a high reward but comparatively less risk than Intraday and

positional trader. Here is 10-20% of profit in some weeks with a risk of 5-7%. Per

trade.

Investor:

The last category is investor, who believes in small

growth is good more than taking risk. They go for a very long term like more than

1 year to 5 or more year of time period. Actually they earn by not only profit

earned from buying and selling stock, but also focus on Dividend, bonus, right

issue etc.

You know well that you can earn money by investing in shares. The following

are the ways through which your money grows.

- Dividend:

Dividend is

nothing but the part of profit company earned and decided to share among the

share holders. Dividend are distributed once in a year as profit is calculated

once in a year generally.

There are two

type of Dividend:

Ø Annual Dividend:

The dividend which is distributed once in a year after closing of financial

year of the company.

Ø Interim Dividend:

The dividend which is provided in middle of the year to appreciate the investors.

Dividends are distributed in different paths, such as: by cash, Bonus,

Right issue. Bonus means Company can provide its share instead of cash with the same value to the existing share holder. Where as Right issue means the issuing share to the existing share holder in discount price, which is available in lower rate than Market price

- Capital Growth:

Investment in equities/ shares leads to capital appreciation. The longer is the duration of investment, the higher the returns. Investment in stocks is associated with risks as well.

- Buyback:

The company buys back its share from the

investors by paying a higher value than the market value. It buys back shares

when it has a huge cash pile or to consolidate its ownership.

For today, This is enough. You can’t grab all knowledge in a day. Understand from the beginning and be pro with sufficient knowledge.

Thanks for Reading🙏

Wise wealth 21st

If you have any doubt please let me know.