Zomato: A food delivery Business model which is a frontline of India’s Food delivery industry and providing a convenient way to review restaurants, feedbacks, listings in (now) over 24 different countries. Zomato, the company is going to raise funds of INR 8250 Crores. INR 7500 Crores will be a fresh issue, and the remaining fund will be offered for sale for its existing investor Info Edge(Naukri). So, What is Business Model?

Background:

As we know problems are the way to innovation, like that when 2 people Deependar Goyal and Pankaj chaddar feel that it is very difficult to order meals in a restaurant by checking the Restaurant menu in a very short lunch period in the middle of the office time they found a way to do something unique. They contact the Restaurants and uploaded their menu to a site they created. They start this journey in 2008 and named its site as foodiebay. It was the evolution of Zomato Business. They started the business in Delhi, Mumbai and Kolkata in the primary stage and then they covered all around India.

So, Earlier Foodiebay and for now Zomato is a platform that is easy to use for order food and get delivered at the doorstep which is a genuinely futuristic model. The Name Foodiebay changed into ‘Zomato’ at end of the year 2010 due to the term ‘eBay in foodiebay. And to do the name more Unique The CEO Deependar Goyal framed it as Zomato.

Company: Zomato

Founder & CEO: Steve

Easterbrook

Year founded: 2008

Headquarter: Gurgaon,

Haryana, India.

Number of Employees (2019): 5000+

Type: Public

Ltd. Company

Monthly Active Users (2019): 70M

Business Model:

Before analyzing the financial data, we need to understand the business model and its growth for the future.

The success of Zomato lies in its Robust business model. Essentially Zomato is an application that works around the provision of food delivery services, provision of information, user reviews, and menus of partner restaurants. Following are the useful segment of the Zomato Business Model:

1.

Customer Segment:

There are 3 kinds of customer segments:-

- Users: Who try to find the best local restaurant as per his/her requirements.

- Local Restaurants: The food businesses that want to reach the customer, or the customer should be found them.

- Reviewers: These are active persons who reviewed the restaurants, food and provide their view and ratings on those.

- Others: In others, I would like to add Database companies as it is Electronic Commerce Operating a business and also market research companies that helps them to work on meeting the absolute requirement of the users or customers.

2.

Customer relationship:

- Zomato provides its customers self-choice freedom by providing all the information.

- · It also

provides quality assurance, coupon and ticket service to engage and good

customer support.

- · It also makes

transparent to the customers by proving up to date Review and Rating system.

3.

Value Proposition:

Zomato is working immensely on its model to provide assurance on Quality, Accessibility, Affordability to its customers. It is quite busy on:

a. Improving food quality and packing

b. Improvising the accessibilities for customers.

c. Providing the food at an affordable price with the help of reviews and ratings.

4.

Key Activities

i. Expand and diversify their service offer

ii. Manage Network effects

iii. Managing to advertise

iv. Maintaining the Brand value

5.

Key Resources:

Top class database, talented reviewers, dedicated employees and huge funding partners are the back the bone of the business.

6.

Channel:

Zomato offers its accessibility to its customers through its well designed and up to date updated with additional featured applications and website to acquire the customer from various backgrounds.

Revenue Channel:

Zomato reported a revenue of Rs 2,605 crore for FY20, which is doubled in compared to FY19. But How Zomato makes money? Let’s see:-

1. Delivery:

As we understood, Zomato is a service provider and its service is the delivery of food. It charged a commission on this service. It is the main source of earning and collects nearly 75% of its total revenue.

2. Zomato Gold:

Zomato has partnered with restaurants to provide complimentary food and drinks to its subscribed members. The membership is called Zomato’s Gold membership program. The annual membership fee is Rs 1,199.00 and the program has over 1 million active subscribers.

3. Ticket sales:

Zomato also sales tickets for various events and shows organized by restaurants and earn commission from them.

4. Promotion of Restaurants:

Zomato also engaged in promoting various restaurants and earned through the promotion of business.

|

| Revenue generated from different sources |

Cost:

As

its revenue increases, the cost increases as well. Total expenses rose by

approximately 37% to Rs. 4,628 crores in FY20. The

cost basically rose by below activities:

- ü Platform Development

- ü Maintaining Network

- ü Branding and Advertising Cost

- ü Office maintenance Cost

- ü Employee’s salary

- ü Legal and Accounting fees

Impact of Covid-19

In 2020, Mostly, every business suffered a huge loss, and also Zomato was one of them. Due to the complete shut down, the business process falls down and occurred losses. But it helps the business platform more solid. But it gains a big point as this pandemic suit the business model and hence helps the company to be more futuristic. The business platform is based on home delivery and the pandemic stands against the public to go out of home and for that reason, Zomato will help people to bring the Restaurant into the home of its customer’s.

Zomato’s Financial Overview:

As Zomato is going to launch IPO, It is very important to understand the financials:

|

Particulars |

Fiscal 2021 |

Fiscal

2020 |

Fiscal

2019 |

Fiscal

2018 |

|

Equity

Share capital (in Rs. crores) |

0.03 |

0.03 |

0.03 |

0.03 |

|

Net worth

(Rs. crores) |

7754.53 |

2,083.10 |

2964.51 |

1,207.85 |

|

Revenue

from operations (Rs. crores) |

2,118.42 |

2,604.73 |

1,312.58 |

466.02 |

|

Loss for

the period/year (Rs. crores) |

(816.43) |

(2,385.60) |

(1,010.23) |

(106.91) |

|

Basic

earnings per share |

(8,496.65) |

(34,121.10) |

(16,027.31) |

(2,243.76) |

|

Diluted

earnings per share |

(8,496.65) |

(34,121.10) |

(16,027.31) |

(2,243.76) |

|

Net asset

value per equity share |

78,863.30 |

30,026.70 |

43,130.82 |

26,140.47 |

|

| The chart refers to above data |

Zomato’s stake Holder:

|

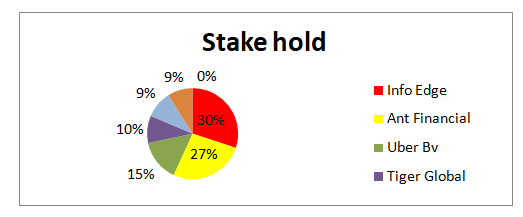

| Zomota's stakeholder details |

The CEO of Zomato is Deependar Goyal, and it’s most of the stock hold by Info Edge(Naukri). Except them, there are also others who holds measure share are Ant Financial, Uber BV, Tiger Global, Sequoia Capital etc.

Alert for IPO:

As this is A huge private limited company recently converted into a public company by amending its MOA and AOA (Important Documents of the Company) will be listed in NSE and BSE. It is eagerly awaited since last year, IPO is going to do some ‘dhamaka’. As per The Economic Times survey, The Company is valued more than Rs. 53,000 Crore. But it is a loss-making company, which is its very big minus point. If Nifty shows some positive vibes at the time of its listing, then it will be a jackpot for the allottees.

Issue size:

The issue size of IPO may be INR 8,250 crore. As Zomato is planning for a fresh issue of share to raise 7500 crores and Rs. 750 Crore by Offer for sale which is held by its one of leading existing shareholder Info edge(Naukri).

Issue Date

and Timeline

Yet there is no specified timeline disclosed for IPO. We will provide full details here, once the report will come out.

Thanks for reading🙏

Wise World 21st🌎

If you have any doubt please let me know.